Welcome to my 1st quarterly review report of Year 2017 that summarizes actions I've taken during the January - March months.

Quarterly reports would provide details such as Portfolio worth, dividend re-investment decisions and also review of progress made towards yearly goals.

Stock Portfolio:

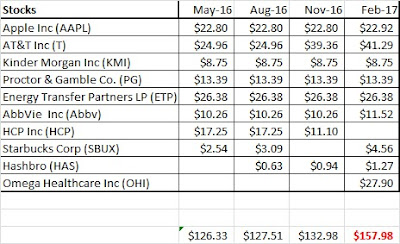

I've updated my Portfolio for your perusal.

The Retirement accounts = 401K and the Roth IRA = $24, 851.28

The Taxable accounts = $45, 060.15

This quarter, I've invested $500 in Loyal3, $3,564 in 401K, transferred $250 in my Scottrade Taxable account and re-invested dividends across all accounts.

Dividend Re-investments:

Purchased 2 shares of WPC @61.599 in my ROTH IRA on 3/30.

Purchased 4 shares of GE @29.6369 in my Scottrade Taxable on 3/28.

Dividends re-invested in Loyal3 and 401K account as well.

Dividend increases during Q1:

OHI raised quarterly dividend from $0.61 to $0.62 on Jan 12th

HAS raised quarterly dividend from $0.51 to $0.57 on Feb 6th

3M raised quarterly dividend from $1.11 to $1.175 on Feb 7th

CSCO raised quarterly dividend from $0.26 to $0.29 on Feb 15th

ABX raised quarterly dividend from $0.02 to $0.03 on Feb 15th

PEP raised quarterly dividend from $0.7525 to $0.805 on Feb 15th

KO raised quarterly dividend from $0.35 to $0.37 on Feb 16th

WMT raised quarterly dividend from $0.50 to $0.51 on Feb 21st

FFIC raised quarterly dividend from $0.17 to $0.18 on Mar 1st

WPC raised quarterly dividend from $0.99 to $0.995 on Mar 16th

INTC raised quarterly dividend from $0.26 to $0.2725 on Mar 23rd

The above dividend increases helped bump my yearly dividends by $22.42

Review of Goal 2017:

Family Goals -

1. Cook a meal once a month FAIL

I've cooked only a single meal, instead of the intended 3 meals.

2. Date night once a month PASS

I've taken time off and spent quality time with my dear wife. Once a month is less but its better than not having anything at all.

3. Spend time with my kids PASS

Our 18 month old is a handful and my wife needs some time off from the kids. When back from work, she runs the errands or takes the 9 year old out for gymnastics and I spend time with the 18 month old.

4. Buy a house In-progress

We're barely begun looking at homes in the area. The Lord willing, we'd buy this year. I would need to sell stock to raise the initial payments.

Finance Goals -

1. Contribute $18,000 towards the 401K PASS

I've made contributions of $3,564 in Q1 towards the 401K. My mode of investing is via the Vanguard 500 Index Admiral (VFIAX) that has a quarterly distribution.

2. Earn $2,500 in dividends and $3K (over 12 month period) In-progress

In Q1, earned a total of $449.33 and my stock portfolio will pay $1810.1 in dividends over the next 12 months.

I've invested $500 in Loyal3 and $3,564 in the 401K but have not made any purchases in the Roth or other taxable accounts. This goal may not materialize if I have to sell stock to accomplish buying of a house.

3. Invest $5,500 in Roth IRAs FAIL

I've invested $600 in my Roth IRA this quarter. Haven't opened an account for the wife as yet.

4. Contribute and Invest HSA dollars FAIL

No contributions this quarter.

5. Contribute $2K in taxable accounts - Loyal3, Scottrade and TD Ameritrade PASS

Invested $500 in Loyal3 and $250 in Scottrade

6. 529 plans FAIL

Yet to open accounts.

Fitness Goals -

1. Run 400 miles thru' the year PASS

I've run a total of 104 miles this quarter and am confident will run in excess of 400 miles in 2017.

2. Ban on Cola consumption PASS

I've been pretty successful. Reduced consumption by 90%.

3. Run a Half marathon In-progress

I've got the mini scheduled on 28th April. Will share more details next quarter.

Spiritual Goals -

1. Read Bible daily FAIL

Need to make this a priority :(

2. Pray w/ family once a week PASS

We're been successful doing the worship/bible read once a week.

Career Goals -

1. Add a certification FAIL

Yet to begin training.

2. Obtain a job in OH, or NC, or Texas FAIL

Not sure whether this would happen this year.

I'll need to evaluate the 2017 goals and may need to strike a few if we plan on buying a home. Having this list does help me stay focused and accomplish more than I would have if I had no goals.

Thank you for reading! Please do let me know whether you're had time to take stock of progress made during the 1st Quarter.